Why Relative Strength?

Relative strength measures how stocks perform compared to the market benchmark. Stocks with strong relative strength tend to continue outperforming. Our RS rankings help you find these leaders before the crowd.

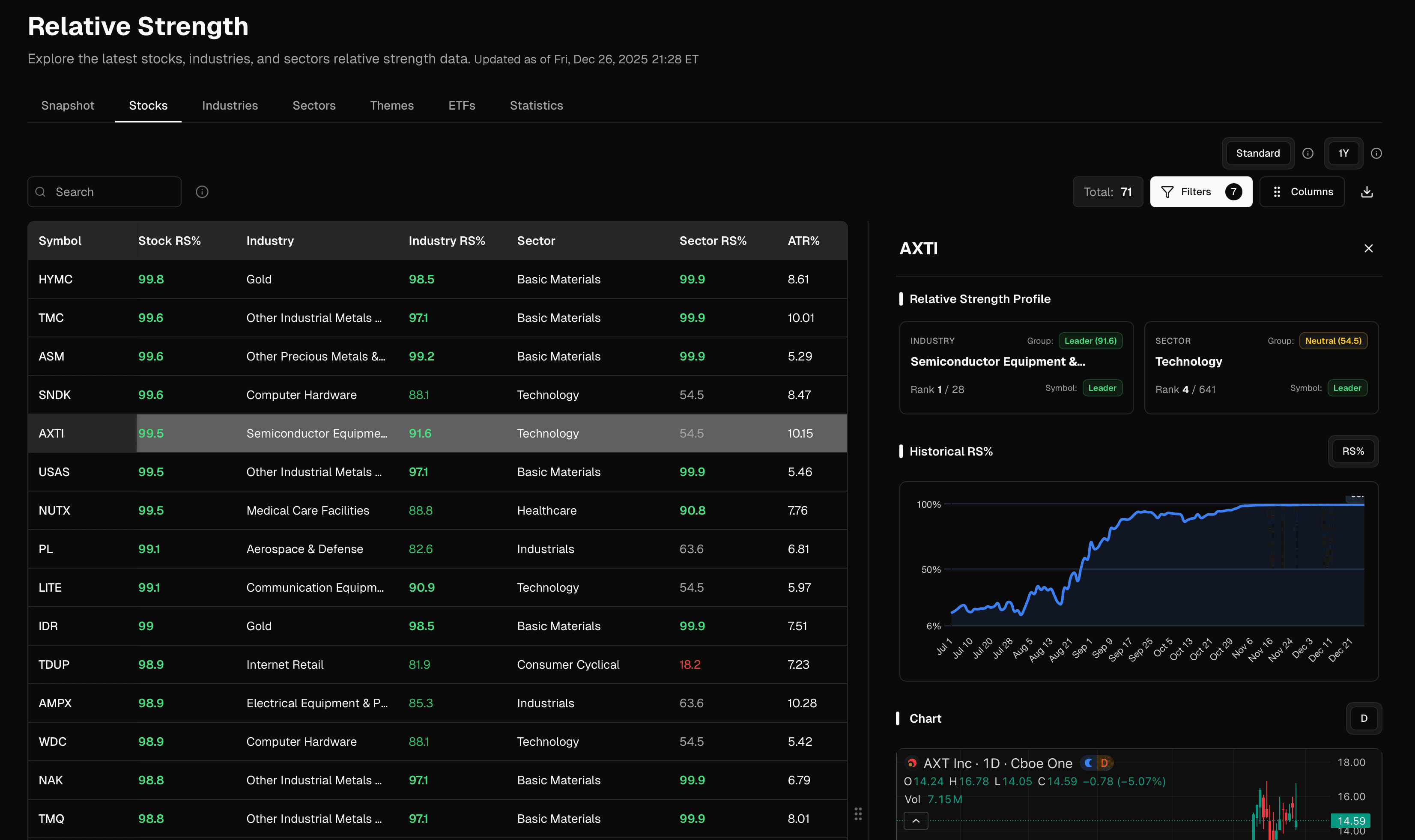

Identify market leaders before major breakouts

Filter 5,000+ stocks to top RS% performers instantly

See how stocks rank within their industry, sector and theme

Focus on momentum, not noise

"You want to own the leading stocks in the leading industry groups."

Workflow in 3 Steps

A data-driven approach designed to identify market pivots and high-probability setups with institutional precision.

Analyze Overall Market Health

Stop guessing. Our Market Breadth Snapshot reveals the internal health of 5,000+ stocks, helping you size your positions based on real market mechanics, not headlines.

- Universe Breadth Snapshot

- Index Breadth Comparison

- New High/Low Analytics

Follow Sector & Theme Strength

Institutional money moves in waves. Our top-down engine traces capital flow from Sectors down to the leading Industries, ensuring you're always trading in the strongest corners of the market.

- Sector Strength Matrices

- Industry Relative Strength

- Thematic Trend Analysis

Identify High-Performance Leaders

Cut through the beta-noise. Use Volatility-Adjusted RS and ATR Extension to identify stocks with genuine institutional accumulation before they break out.

- ATR Extension Scoring

- Volatility-Adjusted RS

- 5,000+ Stock Coverage

Testimonials from Swing Traders

Loading pricing...

Frequently Asked Questions

Everything you need to know about OpenSwingTrading

If you already use charts and patterns but want stronger candidates and better timing, this tool fits naturally into your workflow.

OpenSwingTrading helps you find the right stocks in the right market conditions.

By combining relative strength rankings with market breadth, you avoid forcing trades when swing trading odds are poor — a common discretionary mistake.

OpenSwingTrading does not tell you when to enter or exit.

It helps you:

- Focus on leading stocks

- Trade in favorable market regimes

- Apply your own chart setups with more confidence

You stay in full control.

This keeps the platform aligned with end-of-day swing trading, without distracting intraday noise.

- Check market breadth

- Scan the leaders

- Build a focused watchlist

It's designed to save time, not add screen time.

OpenSwingTrading complements charting platforms:

- Use OST to decide what to look at

- Use TradingView/TC2000/ToS to decide how to trade it

Many users replace hours of manual filtering with a short daily review.

- Avoid bad trades — save money by staying out when market conditions are unfavorable

- Spot market leaders — identify stocks with significant momentum gains early

- Save hours of research — replace time spent across multiple free but messy sites

When you factor in avoiding costly mistakes, capturing better opportunities, and reclaiming your time, the current pricing is positioned well below the value it delivers.

If you decide to upgrade later, you can cancel anytime. No lock-ins.